How sanctioned ownership adds challenges to business partner screening

What is sanctioned ownership? How does it make compliance screening more difficult? Are you at risk? How to avoid violating bans on indirect provisions.

What is sanctioned ownership? How does it make compliance screening more difficult? Are you at risk? How to avoid violating bans on indirect provisions.

Awareness for global trade compliance and export control requirements has significantly increased over the years. In today's globalized markets subject to dynamically changing global trade rules and restrictions, companies are well aware of their basic trade compliance screening obligations.

So, this chapter is easy. Nowadays, especially in politically unstable times and under market uncertainties, no company takes its legal trade compliance obligation lightly. And most companies know by heart that it is prohibited, for example, to provide economic resources to any persons or organizations listed on official embargo lists from the EU.

Most traders are familiar with the EU's "Common Foreign and Security Policy" list – or short, the CFSP list. It is the official EU database and contains all the persons, groups, and entities in the lists of names and anti-terrorism regulations at EU level and in the embargoes at the national level. But bans on provisions are also found in the embargoes against individuals (“anti-terror regulations”) – not just in the EU’s embargoes against countries.

And there are many more official sanctions lists by different authorities across the globe that must be checked and complied with when trading. Of course, there are too many lists and each is too long to check it manually, so most companies work with automated screening solutions. If you don't, take a look at AEB's Compliance Screening for your best option to manage secure and efficient business partner screening.

AEB's Compliance Screening software runs automated business partner screening in the background of your transactions. Optional integration into your ERP/CRM systems such as SAP®, Salesforce, Microsoft Dynamics 365, and more. And with extended content from Dow Jones and Reguvis.

Now it gets more tricky. Because official regulations do not only prohibit direct provisions to sanctioned parties – they also prohibit any indirect provisions. The term itself already indicates that this may not be something that obvious and compliance in this area is a great challenge in everyday business.

In fact, many companies and responsible executives are not even aware of their obligation when it comes to bans on indirect provisions. These restrictions refer to financial or economic resources that are made available to an entity that is not listed on a sanctions list itself but it is owned or controlled by a listed entity.

Compliance with bans on indirect provisions on all applicable transactions across business units from procurement to fulfillment is consequently based on and involves:

So: Do you and your teams really know who owns or controls (full or in parts) the suppliers, partners, agents, customers, and prospects that your company engages with every day? How can you meet the challenge to comply with bans on indirect provisions?

Surely if compliance with regulations is so difficult in everyday business, the authorities have help at hand to make it easier? Well, yes and no: The EU provides Council document 9068/13 offering support in the area of sanctioned ownership. It defines, for example, “control” in this context as an ownership share of more than 50 percent.

But it does not help your sales teams to quickly determine whether the quotation they are working on may go out to a party that is owned or controlled by another party to such an extent that it may prohibit a trade transaction. And unfortunately, the EU does not offer any tools and lists in this area for efficient screening.

But it gets better: Not only EU and UK regulations call for international compliance with bans on indirect provisions: the US Office of Foreign Assets Control (OFAC) is responsible for embargoes in the US. And OFAC applies the “50 percent rule” in the area of sanctioned ownership.

This means that if a company is not directly listed but is owned to at least 50 percent by a company or a person ("controlling ownership") listed on the US Specially Designated Nationals and Blocked Persons List (SDN), then it must be treated the same way as a listed company.

To conclude: Ownership structures of business partners are not transparent in daily business. Official trade restrictions, however, cover bans on both direct and indirect provisions. And official export control authorities do not provide lists or tools that support compliance in everyday business.

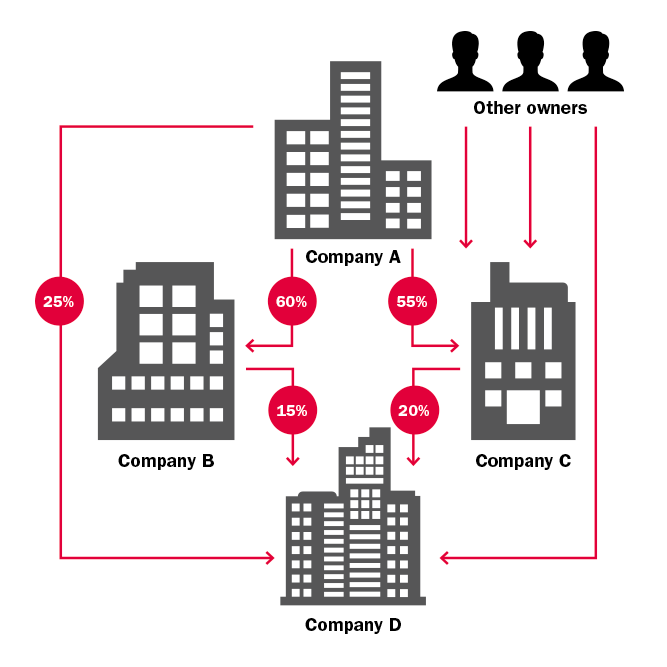

A picture speaks a thousand words. So take a look at the following illustration that visualizes an example of ownership structures based on four interconnected companies. In words, this visualization displays:

Basically, it means that screening all business transactions against all relevant sanctions lists still leaves risk exposed. Comprehensive compliance includes an understanding of the ownership structures of all business partners – from the very top in the chain of parent companies to all involved natural entities (shareholders) – and screening of all relevant parties.

Today, ownership structures of businesses across the globe can be quite complex – and they’re not necessarily transparent either. Identifying them requires serious – and repeated – research as ownership structures are not set in stone and can develop quite dynamically.

There are many discussions on this topic in business communities across markets and regions worldwide: Considering the complexity of the task, can companies really be required to manage such background checks in daily business? Is this reasonable or even feasible? Fact is, unless applicable courts rule differently, it’s the law and compliance is required.

How do you manage trade compliance screening in your organization? Do you cover both direct and indirect bans on provisions? Contact us if you would like to discuss your software requirements. In partnership with Dow Jones Risk and Compliance, AEB delivers comprehensive screening packages to meet your due diligence requirements.

Bans on indirect provisions? PEP List? Adverse Media? Comprehensive security for your transactions with AEB software and extended content from Dow Jones.