plus setup fee

plus setup fee

plus setup fee

plus setup fee

plus setup fee

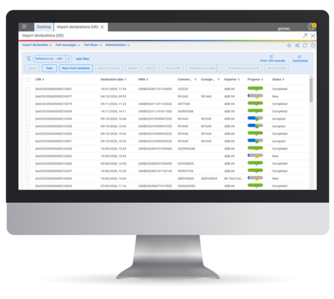

- Automated or manual completion of customs declarations Automated or manual completion of customs declarations

- Direct connection of customs communication via a central, high-performance data center

- Support for all standard import and transit procedures

- Create import documents (Full frontier declarations, simplified frontier declarations, supplementary declarations)

- Revision-safe storing of records

- Electronic customs tariff (TARIFE)

- Intelligent templates

- Automated email notifications

- Data to support analytics

- Integrated wizard

- Support

- Transit procedures (NCTS Authorized Consignee (CE))

- Reporting & Analytics*

- Integration into other ERP systems*

- Prerequisite: CSP badge from Pentant**

* Price on request

** Add. costs: EUR 141.70/month + EUR 1.11/declaration